Obviously I am a big semiconductor bull, but I also like to own monopolistic/duopolistic/durable-demand companies regardless of sector.

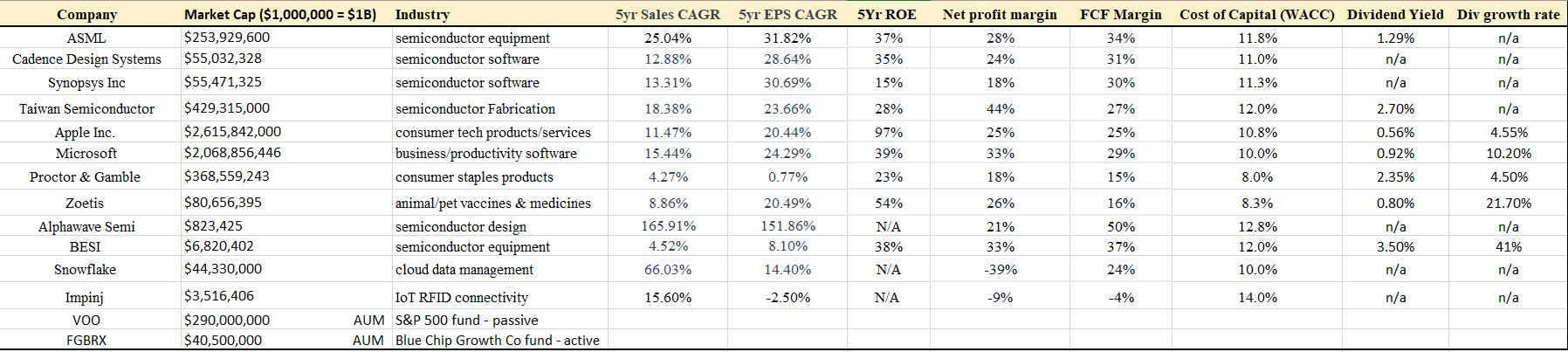

Below is the current portfolio with individual margin profiles & bull-cases explained.

Bull cases (reasons for owning).

ASML - This company has a monopoly on Extreme Ultraviolent (EUV) lithography machines, which are able to produce EUV light. Lithography is the key process in the physical production of semiconductors, especially the cutting edge chips that power technologies like smartphones, data centers, ChatGPT’s machine learning, autonomous driving, and more. These technologies rely on chips with billions of transistors - the tiny building blocks of all electronics today that enable the technologies above to essentially do boolean algebraic math (1s & 0s) at unfathomable scale/speeds. The more advanced the chip, the more transistors that are needed, and that means smaller & smaller transistor sizes.

EUV light has a wavelength of 13 nanometers and is required in order to generate the physical reaction that results in the creation of transistors as small as 5, 3, and now 2 nanometers. For context, the width of a human hair is around 70,000 nanometers. I can go on, but rest assured, the most recent iphone models, Tesla cars, fast & easy video streaming, and Chat GPT/AI LLMs would not exist today if EUV lithography machines were not supplied by ASML. So long as the producers of these technologies want to meet/profit from customer demand for their products, they will need ASML’s EUV lithography machines.

Cadence & Synopsys: Where ASML is an integral part of the construction crew of the most advanced chips (buildings), Cadence Design & Synopsys are the architect’s protractor, ruler and pencils needed to produce the blueprints that the contruction crew follows in order to bring these chips to fruition. The two have an effective duopoly on electronic design automation software (EDA) that chip designers like NVIDIA, AMD, Qualcomm, Apple, Intel etc MUST use in order to design the chips that eventually are lithographed/physically created by companies like ASML.

The aforementioned fabless companies (amongst many others) are architects of the chip industry, and cannot function without using the chip architectural software tools provided by Cadence and Synopsys. These tools are mission critical, and essentially will be the last costs cut by these types of companies. If they are ending their EDA licenses, they are going out of business or at very least ceding the competitive cutting edge and thus customers, revenue/profits going forward.

Furthermore, large internet hyperscalers like Amazon, Google, Facebook, and car companies etc are designing chips for their datacenters themselves in-house (Amazon’s chip design team has expanded from the low hundreds to over 1,000 employees in the past couple years). CDNS & SNPS’s subscription licenses are on a per-desk basis, so as these large companies join the legacy chip designers in needing EDA, Cadence & Synopsys’s revenues will continue to grow. Finally, the on-going generative AI boom has brought with it a boom in both GPU/ML fabless chip design startups looking to take a piece of Nvidia’s cake. Companies like Tenstorrent and Cerebrus, which as they scale will be another source of demand for EDA software licenses.

Additionally, these EDA names’ business cycles revolve around the research & development spend cycle of semiconductor designer companies. This R&D spend is essential for these designers to stay on the cutting edge both node-size wise, performance and cost-wise. As mentioned previously, a company like AMD that’s in neck-and-neck competition with another, and begins slashing r&D spend is effectively ceding the edge, and thus future customer business. Their competitors product’s down the line will be more attractive to customers like Apple, Microsoft, Baidu etc, despite the short-run R&D cost needed to ensure that future edge.

This timeline differs from that of the semi-cap or fab companies, whose spending is more tied to end-customer civilians spending patterns. If Apple sees I-phone demand down significantly and slashes orders from TSMC, then the Taiwanese probably will not be ordering that marginal etching or deposition machine. But Apple knows that if it stops innovating chip-design wise, then Samsung smartphone processors’ performance could eventually out-perform their mobile processor chip, and lead to market share loss. EDA software enables this continued chip design innovation and thus is mission critical for the fabless chip companies.

Taiwan Semi -

Apple - If I offered you $10,000 on the condition that that you give up your Iphone and can never purchase one again, & instead be consigned to using a flip phone for the rest of your days - you would not take that deal. I have an Iphone, and so do you, and you constantly use it. You use it for all sorts of reasons, and would be enormously less efficient if you did not have one. Sure, android phones are capable of the same functions (texting, web-surfing, social communication, calls, mapping etc) - but they have long been roughly 50% of the cost of Iphones…why hasn’t everyone switched over if they were truly equivalent to Iphones? They are more laggy and cumbersome operating-system wise, and the green texts!! Kidding, but you get my point, and I won’t spend anymore time explaining why Apple is and will continue to be enormously profitable.

MSFT - Microsoft will leverage its partnership with OpenAI by incorporate its generative AI into most aspects of its business software offering in order to raise license prices for businesses up and down the spectrum. This will be a boon for sales and more so for margins in the mid-long term.

P&G - Owned it for a long time; I use its bodycare products as do most people I know. And we will continue to in perpetuity because their products are fairly priced, ubiquitous, and we will always want to keep ourselves healthy and clean for appearances purposes if nothing else.

Zoetis - Dominant player in livestock/pet vaccines and medicines. Profitable and stable grower. Humans will continue to want to consume animal meat (livestock) and we will also continue to get, and take care of our pets as one would a family member.

Alphawave - See my other post. I would refer you to Fabricated Knowledge Substack for the best DD out there. Not even going to attempt to explain/analyze AWE better than him.

BESI - Hybrid Bonding.

Snowflake -

Impinj -